Probate Records

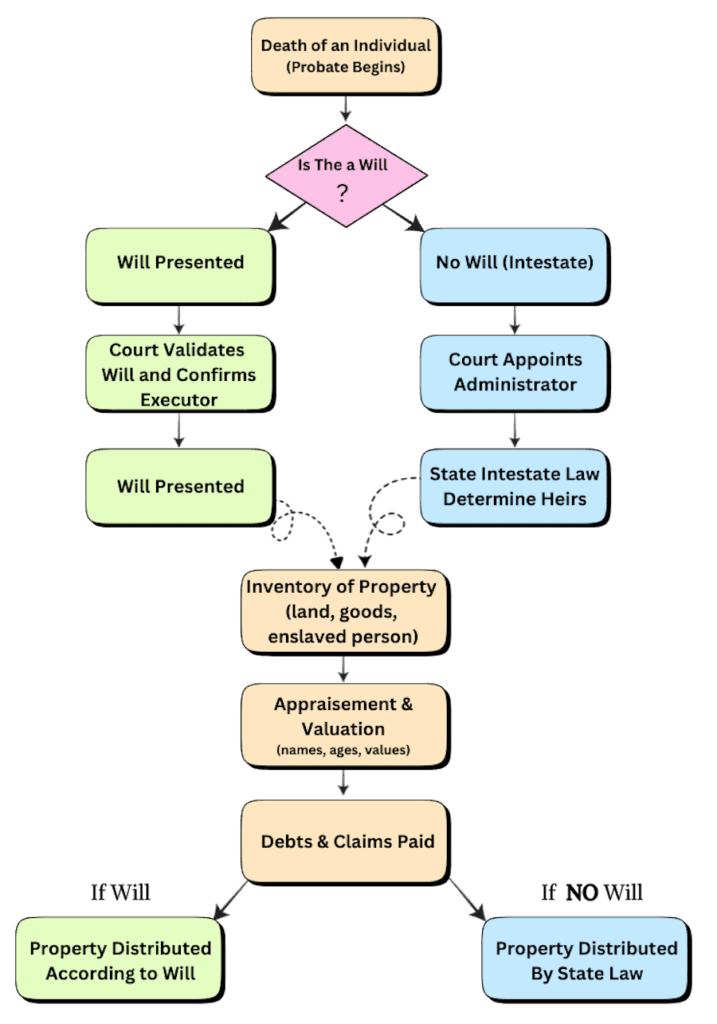

A probate record is a legal document that deals with the distribution of a person’s estate after their death. It includes a court-supervised process to validate a will (if one exists), inventory assets, settle debts, and distribute property to heirs.

During American slavery, especially in the 18th and 19th centuries, enslaved people were legally defined as property. As such, they appear in probate records alongside livestock, land, and household goods. These records are now invaluable for reconstructing the lives of enslaved ancestors.

Why it matters: For many African American families, probate records may be one of the earliest surviving documents where an ancestor is mentioned by name.

What Is in a Probate Record?

During the slavery era, probate records might include:

- ➡️ The will of the deceased (if one existed)

- ➡️ An inventory of property—land, livestock, household goods, enslaved individuals

- ➡️ Appraisals naming enslaved people with age, health, and assigned value

- ➡️ Bills of sale or receipts if enslaved persons were sold to cover debts

- ➡️ Distributions showing heirs receiving enslaved people as property

💡 Research Note: The estate inventory and appraisement lists are often the most detailed source of enslaved individuals’ names. Even if no will survives, an estate inventory can preserve the identities of entire family groups.

Locating Probate Records

Probate records are among the most valuable genealogical sources for tracing enslaved ancestors. They often contain names, ages, relationships, and conditions otherwise undocumented.

- State Archives & Libraries

- ➡️ As records aged, many counties transferred originals or microfilmed copies to state archives. This makes state-level repositories essential research stops.

- Example: The Georgia Archives and Virginia State Library both hold large collections of county-level probate records spanning the slavery period.

- University & Special Collections

- ➡️ Universities with Southern history programs often maintain probate-related papers in their manuscript collections.

- Why this matters: Private family papers donated to universities may include original wills, estate books, or even receipts for enslaved people that are not available anywhere else.

- Published Abstracts & Genealogical Books

- ➡️ Many genealogical societies have abstracted or indexed probate files into published volumes.

- ➡️ By-line summaries of early probate cases.

Probate Records on Ancestry.com

The following collections on Ancestry.com contain digitized probate records for multiple states. These databases are searchable by county, year, and individual name.

➡️ Research Note: Ancestry’s probate databases often include indexed names, but always review the original images—indexes sometimes skip enslaved individuals who were not listed as heirs.

Probate Records on FamilySearch

FamilySearch provides free access to probate collections, often in image-only form without full indexing.

| FamilySearch | ||||||

| Alabama, Probate Records, 1809-1985 | Arkansas, Probate Records, 1817-1979 | Delaware Probate Records - Full-Text Search | Florida, Probate Records, 1784-1990 | |||

| Georgia, Probate Records, 1742-1990 | Kentucky, Probate Records, 1727-1990 | Louisiana Probate Records - Full-Text Search | Maryland, Probate Estate and Guardianship Files, 1796-1940 | |||

| Mississippi, Probate Records, 1781-1930 | North Carolina, Probate Records, 1735-1970 | South Carolina, Probate Records, Bound Volumes, 1671-1977 | South Carolina, Probate Records, Files and Loose Papers, 1732-1964 | |||

| Tennessee, Probate Court Books, 1795-1927 | Tennessee, Probate Court Files, 1795-1955 | Texas, Probate Records, 1800-1990 | Virginia Probate Records - Full-Text Search | |||

| West Virginia Probate Records - Full-Text Search | ||||||

➡️ Tip: When using FamilySearch, you may need to browse by county and volume instead of searching by name. Check estate inventories and loose probate packets page-by-page.

Probate is more than just the reading of a will. The two serve different functions:

A will is a document expressing last wishes.

Probate is the legal process of proving and carrying out those wishes.

➡️ Why it matters: Even if no will survives, the probate process may have generated guardianship papers, bonds, and inventories—still listing enslaved people.

If someone dies with a will, the executor follows their wishes. If someone dies without a will (intestate), the court appoints an administrator and distributes property according to state law.

The probate process generated documents at nearly every stage. Even if a will was not present, the inventory, appraisement, and distribution steps were required by law. These often include the most detailed information on enslaved individuals.

The language used in 18th- and 19th-century probate files can be jarring and painful, but understanding it is key to finding ancestors.

➡️ Example: A phrase such as “Negro woman Sarah and her three children” could identify an entire family unit that otherwise left no trace in the historical record.

➡️ Reminder: Enslaved people may appear under first name only. Cross-referencing multiple probate files within a county can help reconstruct families and communities.